10 Simple Techniques For Life Insurance

Wiki Article

Not known Details About Life Insurance Online

Table of ContentsThe Main Principles Of Term Life Insurance The Ultimate Guide To Whole Life Insurance LouisvilleSome Known Factual Statements About Kentucky Farm Bureau Indicators on Life Insurance Company You Need To KnowUnknown Facts About Life Insurance Quote OnlineThe 8-Minute Rule for Cancer Life InsuranceLife Insurance Online Things To Know Before You Buy

Pick a Strategy and Register Different sorts of plans assist you obtain and also spend for treatment in a different way - Whole life insurance Louisville. Fee-For-Service (FFS) strategies typically use two approaches. Fee-for-Service (FFS) Plans (non-PPO) A conventional type of insurance coverage in which the health insurance will either pay the medical company directly or reimburse you after you have actually submitted an insurance policy case for every covered medical expense.This approach might be a lot more costly for you and require added documentation. Fee-for-Service (FFS) Plans with a Preferred Provider Company (PPO) An FFS choice that enables you to see medical providers that decrease their charges to the strategy; you pay much less cash out-of-pocket when you utilize a PPO company. When you go to a PPO you usually will not have to submit insurance claims or paperwork.

The Ultimate Guide To Life Insurance Online

In "PPO-only" options, you should utilize PPO companies to obtain advantages. Health And Wellness Maintenance Company (HMO) A health insurance plan that offers treatment with a network of medical professionals as well as medical facilities particularly geographic or solution areas. HMOs work with the health treatment service you get and also free you from finishing paperwork or being billed for protected solutions.Some HMOs are associated with or have setups with HMOs in other solution areas for non-emergency treatment if you travel or are far from residence for prolonged durations. Strategies that provide reciprocity review it in their brochure. HMOs limit your out-of-pocket expenses to the fairly reduced amounts received the benefit brochures.

The referral makes certain that you see the best provider for the care most proper to your problem. Treatment received from a supplier not in the strategy's network is not covered unless it's emergency care or the plan has a reciprocity plan. HMO Program Offering a Point of Solution (POS) Product In an HMO, the POS product lets you utilize carriers who are not part of the HMO network.

The Senior Whole Life Insurance Statements

You generally pay greater deductibles as well as coinsurances than you pay with a plan supplier. You will likewise require to file a claim for reimbursement, like in a FFS strategy. The HMO strategy wants you to use its network of service providers, but identifies that occasionally enrollees intend to select their own company.Consumer-Driven Wellness Plans (CDHP) Describes a vast array of techniques to give you a lot more incentive to control the price of either your health and wellness benefits or healthcare - Whole life insurance Louisville. You have better liberty in investing wellness treatment bucks as much as an assigned amount, and you receive full insurance coverage for in-network preventative treatment.

The tragic restriction is normally higher than those common in various other plans (Whole life insurance). High Deductible Health Insurance (HDHP) A High Deductible Health Insurance is a medical insurance plan in which the enrollee pays a deductible of at the very least $1,250 (Self Only protection) or $2,500 (household insurance coverage). The yearly out-of-pocket quantity (consisting of deductibles and also copayments) the enrollee pays can not go beyond $6,350 (Self Just insurance coverage) or $12,700 (family members insurance coverage).

The Life Insurance Company PDFs

HDHPs can have very first dollar insurance coverage (no insurance deductible) for preventive treatment as well as higher out-of-pocket copayments and also coinsurance for services received from non-network providers. HDHPs supplied by the FEHB Program establish and also partially fund HSAs for all eligible enrollees as well as offer an equivalent HRA for enrollees who are ineligible for an HSA.To find out more please testimonial our HDHP Fast, Truths. Health Compensation Plan (HRA) Wellness Reimbursement Arrangements are a typical attribute of Consumer-Driven Health Plans - Whole life insurance. They may be described by the health and wellness strategy under a different name, such as Personal Treatment Account. They are also offered to enrollees in High Deductible Health Insurance Plan that are ineligible for an HSA.

Wellness Financial Savings Account (HSA) A Health Interest-bearing accounts allows individuals to spend for existing health costs and also conserve for future competent medical expenditures on a pretax basis. Funds deposited into an HSA are not strained, the balance in the HSA grows tax-free, as well as that quantity is readily available on a tax-free basis to pay medical costs.

What Does Term Life Insurance Mean?

HSAs are subject to a number of guidelines and also restrictions established by the Division of Treasury. See Division of Treasury Source Center to learn more.There are various kinds of insurance policy that shield versus monetary loss. Common insurance kinds consist of property, vehicle, wellness, as well as life insurance policy. Each of the common insurance kinds have a variety of sub-types resulting in a vast array of options even for simply the typical insurances. Past the typical insurance coverage types there are also a variety of other insurances that vary from requirements like traveling insurance policy as well as warranties, to FDIC warranties and employee's payment.

The Facts About Kentucky Farm Bureau Revealed

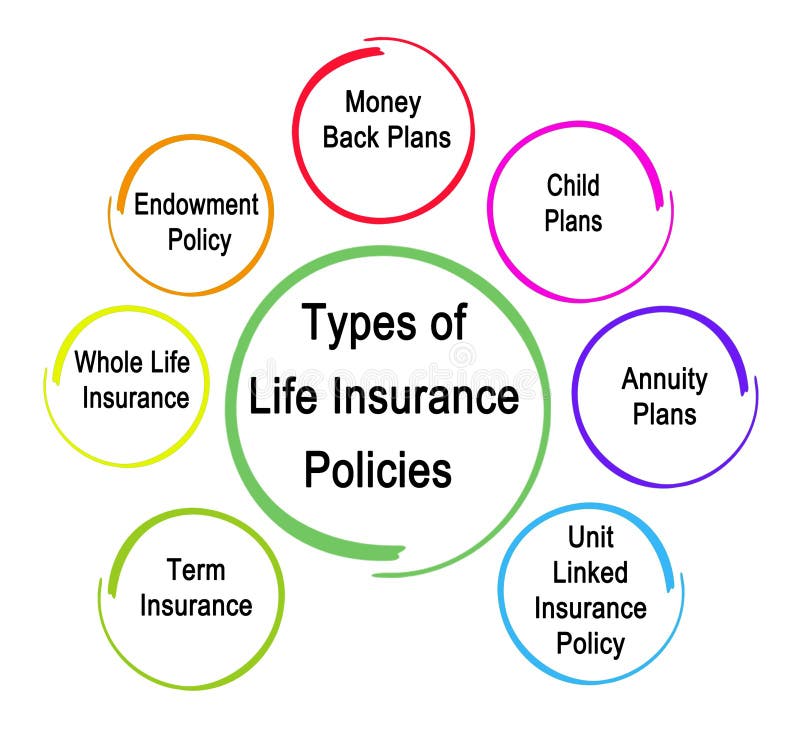

Beyond what kind of lorry is insured there a number of various kinds of vehicle insurance in relation to what the vehicle driver is liable for in the occasion of a crash and also what lawful, medical, as well as car related costs the insurer will certainly be accountable for. Usual medical insurance types consist of: Responsibility insurance coverage Accident coverage Comprehensive insurance coverage Accident protection Uninsured/ Underinsured Vehicle Driver Security There are a number of various sorts of life insurance policy, yet there are just two major types those are term and entire life.Typical read here kinds of life insurance policy include: Term life Entire life Universal life Variable life Whether it's an industrial or house numerous kinds of realty require residential or commercial property insurance coverage - Term life insurance Louisville. Various other big ticket products like watercrafts and even a car might be considered residential property, and while these are insurable we will cover those under various sections.

Typical building insurance coverage kinds consist of: Property owners insurance policy Renters insurance coverage Flooding, quake, and other catastrophe insurance policies Mortgage as well as title insurance policy Organization Insurance as well as Commercial Building Insurance Much like home business property owners as well as entrepreneur require their own types of insurance. Because "service" is an overarching topic some service insurance coverage's consist of various other insurance policy kinds.

Getting My Child Whole Life Insurance To Work

Vital insurance kinds for company owner include: Business proprietor's insurance coverage Professional responsibility insurance coverage Commercial home insurance Additionally included are points like air travel, computer, marine, and also much more. When businesses make use of expensive tools or run cars they generally have insurance policy choices for these things as well as their liability. Traveling Insurance Considering That traveling is an usual thing providing traveling insurance coverage it's very own insurance coverage kind makes good sense.Report this wiki page